CHICAGO – As the Democratic National Convention kicked off on Monday, Vice President Kamala Harris called for upping the corporate tax rate as the party’s presidential nominee unveiled her first big ticket proposal to raise revenues.

The Harris campaign confirmed to that the vice president is proposing to raise the rate major businesses pay from 21% to 28%, describing it as “a fiscally responsible way to put money back in the pockets of working people and ensure billionaires and big corporations pay their fair share.”

“As President, Kamala Harris will focus on creating an opportunity economy for the middle class that advances their economic security, stability, and dignity,” campaign spokesman James Singer added in a statement.

TRUMP, VANCE, HIT KEY BATTLEGROUND STATES THIS WEEK TO COUNTER-PROGRAM DEMOCRATS’ CONVENTION

Vice President and Democratic presidential nominee Kamala Harris speaks at the Hendrick Center for Automotive Excellence on the Scott Northern Wake Campus of Wake Tech Community College in Raleigh, North Carolina, on August 16, 2024. (ALLISON JOYCE/AFP via Getty Images)

The move, if it became law, would likely raise hundreds of billions of dollars, according to projections from the nonpartisan Congressional Budget Office.

The announcement comes as Harris is beginning to offer details on how she’d govern if she is elected president, and how she would try to pay for expensive ideas she proposed last week, including expanding the child tax credit and easing the cost of homeownership and lowering medical debt.

HARRIS AND TRUMP HOLD DUELING RALLIES IN THE BIGGEST OF THE BATTLEGROUNDS

The announcement would also constitute a major rollback of the 2017 tax cuts – the signature domestic legislation passed during former President Trump’s administration – which dramatically cut the corporate tax rate from 35% down to 21%.

Trump has pledged to cut taxes if he returns to the White House.

“Our plan will massively cut taxes,” Trump said at a campaign event Monday at a factory in York, Pennsylvania. “I gave you the best tax cut in history.”

Republican presidential nominee former President Donald Trump speaks at a campaign event at Precision Components Group, Monday, Aug. 19, 2024, in York, Pa. (AP Photo/Matt Slocum) (AP Photo/Matt Slocum)

And he signaled that he would aim to use tariffs against competitors and allies alike by pushing for legislation called the “Trump Reciprocal Trade Act.”

But the Harris campaign charges that Trump’s proposed tariffs on overseas goods “would punish middle and working class Americans, so he can cut taxes for the richest Americans.”

Portions of the Trump tax cuts sunset at the end of 2025, which will spur a major debate next year over what parts should be extended.

TRUMP RUNNING MATE VANCE AIMS TO TURN BLUE WALL STATES RED

Trump campaign senior adviser Jason Miller pointed to the Harris proposal in a social media post, writing “bye-bye economic growth, new hirings, investment, expansion, onshoring, and so much more!”

The new stance by Harris also aligns her with the most recent federal budget proposal by President Biden, which also proposes boosting the corporate tax rate to 28%.

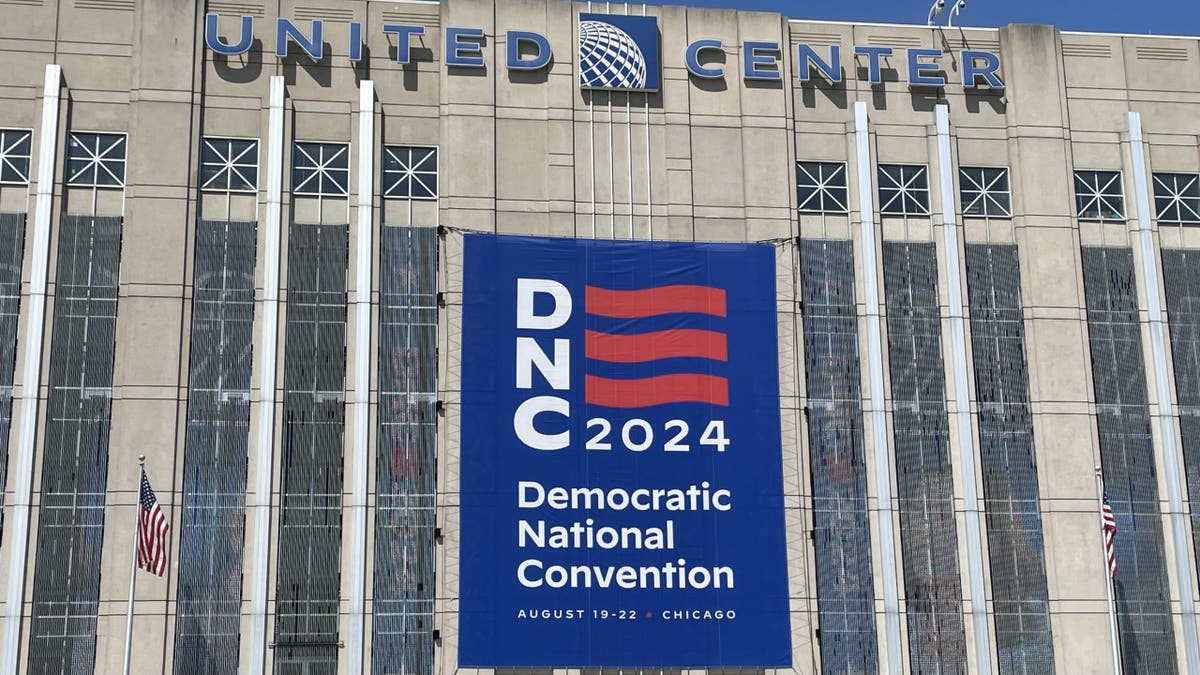

An exterior view of Chicago’s United Center, where the Democratic National Convention kicked off on Monday, August 19, 2024 ( – Paul Steinhauser)

Harris replaced Biden four weeks ago at the top of the Democrats’ 2024 ticket, after Biden announced he was ending his re-election bid and supporting his vice president as his successor.

CLICK HERE TO GET THE APP

But veteran Republican consultant and strategist Alex Castellanos told such proposals will do Harris no favors at the voting booth.

“She does not need the spotlight on her or her polices. She’s been two sides of too many issues. And if she supports raising the corporate tax, that’s a job killer. You don’t need to hurt working people directly. All you need to do is hurt the companies working people work for,” Castellanos argued.

‘ Emily Reynolds contributed to this report

Get the latest updates from the 2024 campaign trail, exclusive interviews and more at our Digital election hub.